Small businesses are the backbone of both local and global economies. And while businesses spend countless hours trying to understand their customers, a comparatively small amount of ink is spent trying to understand small businesses.

Now, we’ll look at some of the most recent and interesting data available on the state of small business and entrepreneurship to get a deeper understanding of how small businesses operate, how they create opportunity, and who’s most likely to pursue business ownership.

1. How many small businesses are there?

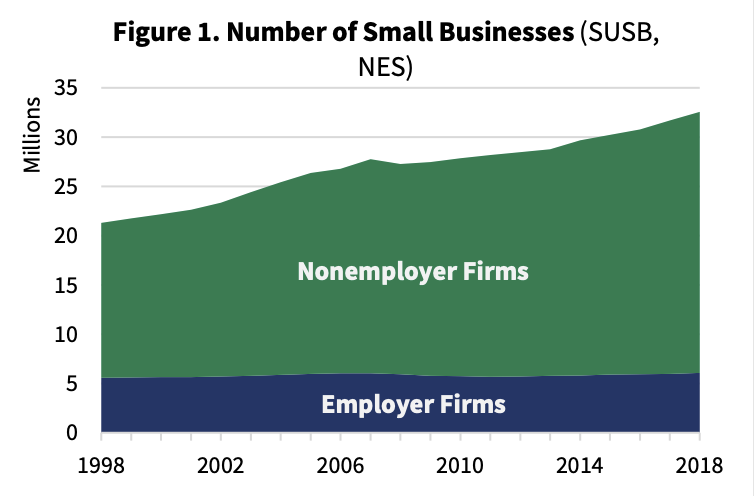

According to 2021 data from the Small Business Administration, there are 32,540,953 million small businesses in the US alone.

Of these businesses, 81% have no employees (termed “nonemployer firms”), and 19% have paid employees (termed “employer firms”). There are 20,516 “large businesses” as defined by their employee count: 250 minimum employees for some industries and as high as 1,500 minimum employees for other industries.

2. Why do people want to start a business?

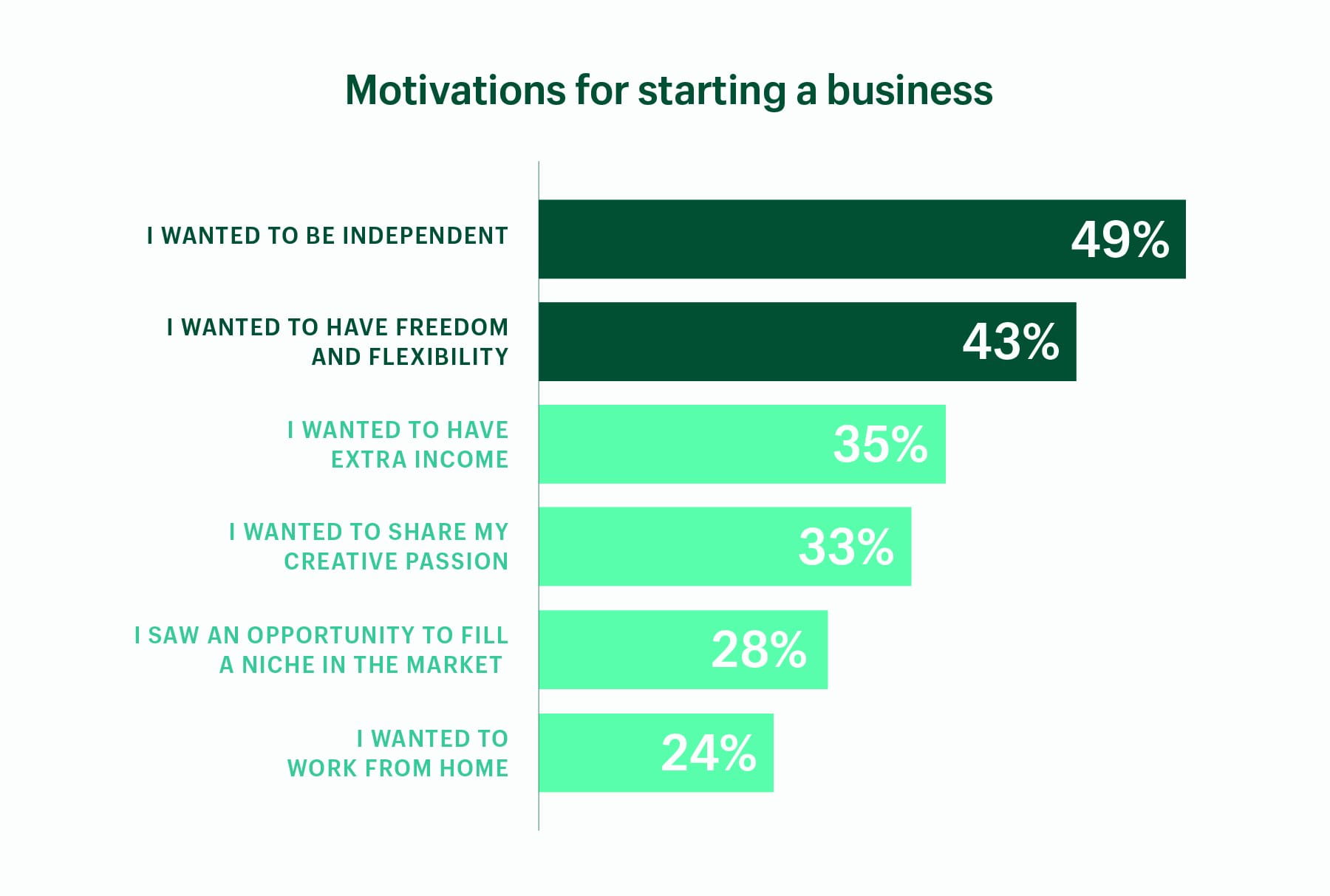

Shopify’s research shows that these are the most common reasons for starting a business:

- 49% of business owners wanted to be independent

- 43% of business owners wanted to have freedom and flexibility

- 35% of business owners wanted to have extra income

- 33% of business owners wanted to share their creative passion

- 28% of business owners saw an opportunity to fill a niche in the market

- 24% of business owners wanted to work from home

The motivations to start a business run the gamut and are ultimately determined by the founder’s goals and aspirations. However, survey data like Shopify’s show that there are a few common patterns to be found among founders.

Freedom, flexibility, and independence are some common drivers for new and aspiring small business owners. Money is, of course, a common factor, as is expressing one’s creative passion or the pull of fulfilling a currently unmet need in the market.

3. How many small businesses are being created?

How many businesses are started each year? The Census Bureau releases an update every three months that shares new data on the number and type of small businesses being formed in the US.

Since Q3 of 2020, there has been a noticeable surge in applications for form a small business. This growth in small business formations has held for nearly the past two years, with 2021 seeing a record-breaking 5.4 million applications—a 53% increase from 2019, which was already a notably strong year for the US economy.

What’s interesting to note is that this increase in new small businesses is actually a reversal of a decades-long decline in the US and goes against the normal result of a recession, which typically sees a decline in the overall number of businesses being formed.

4. How many small businesses get funding?

Startup costs can vary depending on the type of business you start, what the market looks like in your area, and which vertical you operate in. Costs for starting an online business have surely shrunk over the years, but becoming a beverage distributor still carries high upfront costs.

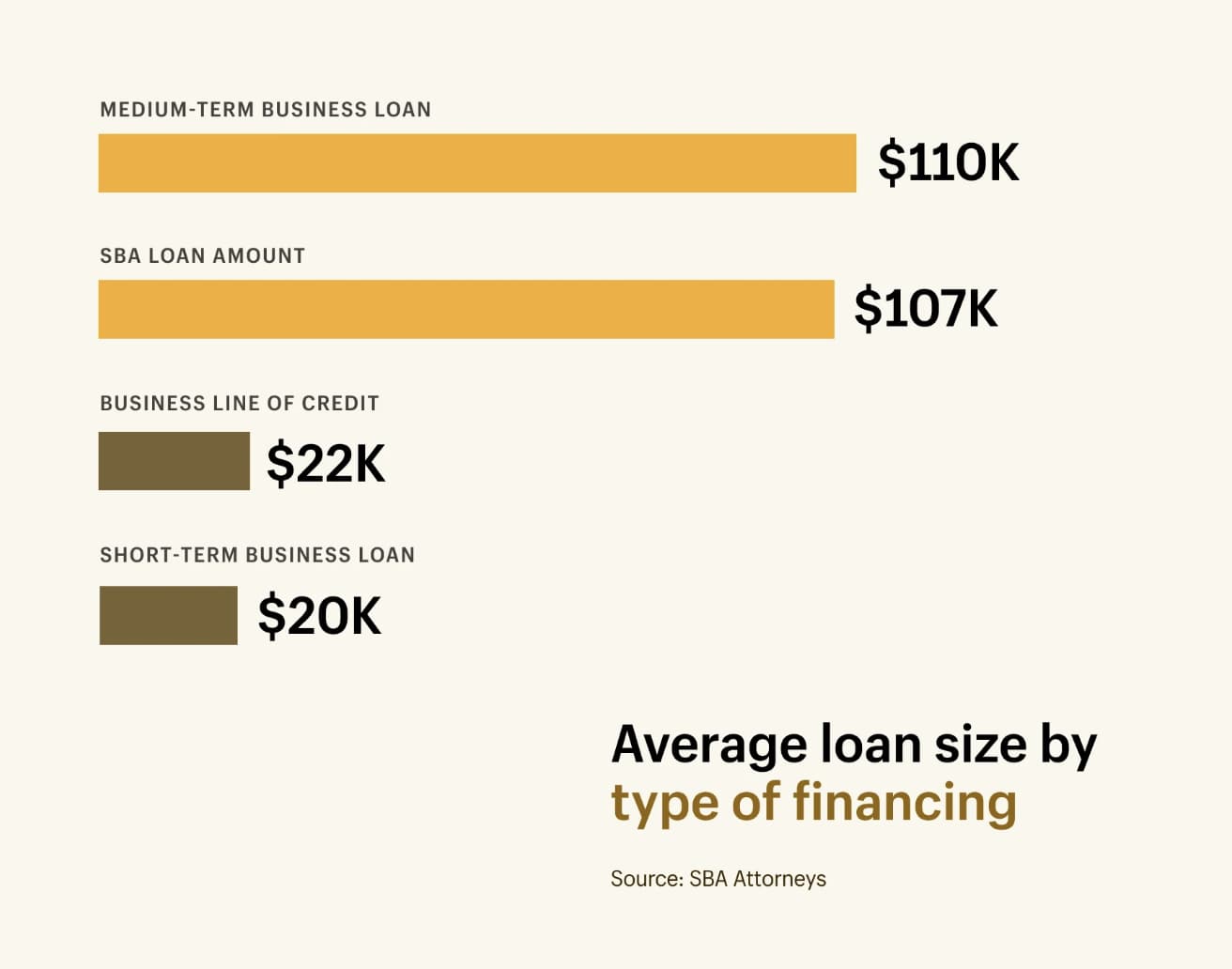

No wonder then that roughly 43% of small businesses apply for a loan, according to the Federal Reserve’s Small Business Credit Survey. The amount that a small business receives from a loan depends on what they ask for and also depends on the type of loan.

According to research from SBA Attorneys, both medium-term and SBA business loans top out at over $100,000 on average, while short-term loans and lines of credit average around $20,000.

5. How many businesses are selling online?

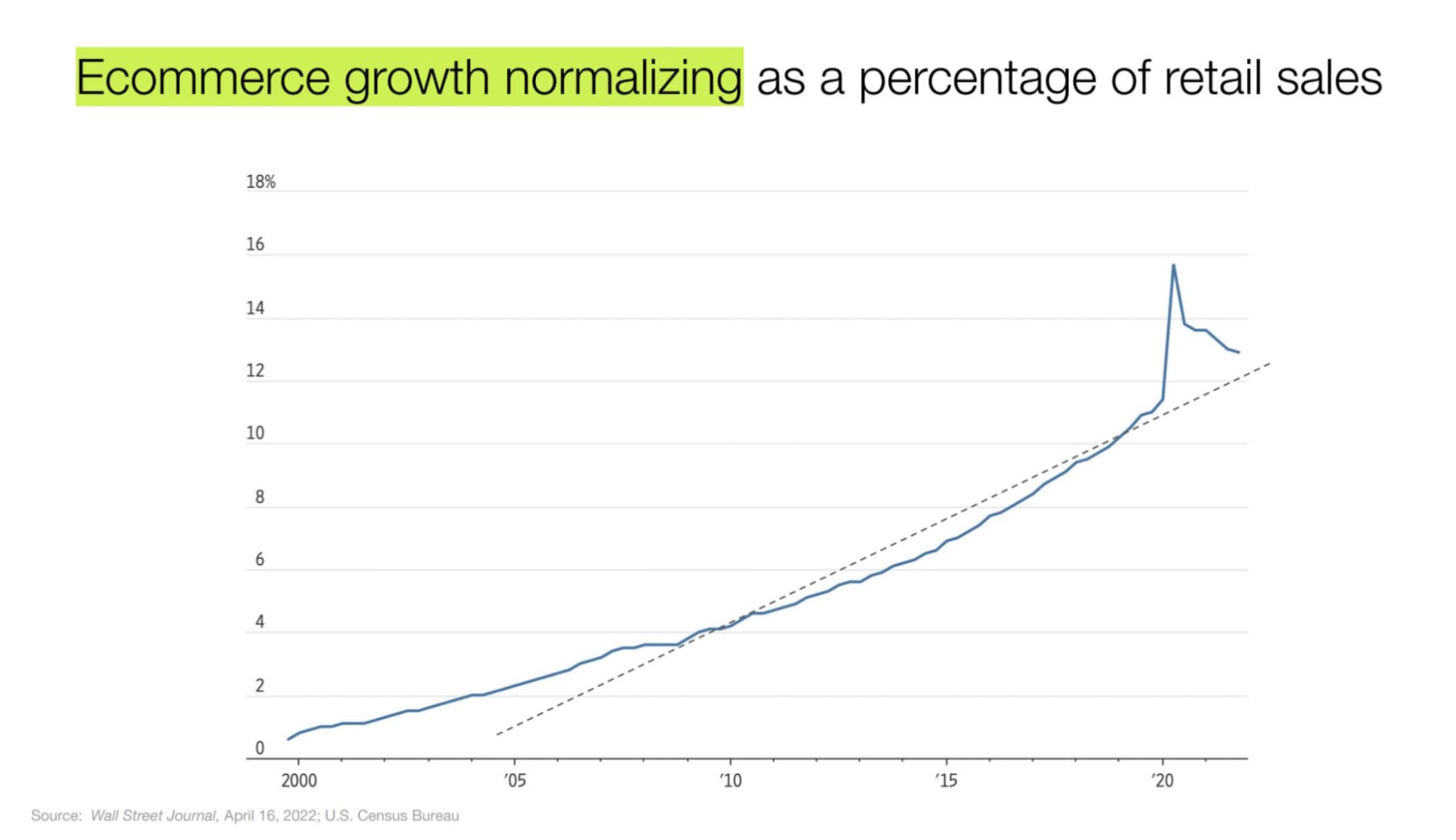

Over the past 30 years, the predominant trend in retail sales has been ever-increasing ecommerce penetration, or more and more retail sales happening through online channels. This was dramatically accelerated during the onset of the pandemic, especially in countries like the US, and has slowed down in the past year.

Still, the trendline is still heading upward for ecommerce sales. Put another way, the pandemic pulled demand forward, but it looks like we’re returning to the trendline prior to Q2 2020.

What remains to be seen is if the recent decline in relative ecommerce sales is a result of consumers preferring to shop in person after the restrictions faced during the pandemic.

6. What percentage of small businesses fail?

Data from the Bureau of Labor Statistics shows that an average of 80% of employer businesses survive the first year, 70% survive at least two years, 50% survive at least five years, and 30% survive at least ten years. Going the distance with a small business is very hard: of all businesses that are started in the US, only 25% of businesses ever last for 15 years or more.

Figuring out the reason why small businesses fail is trickier because “failure” simply means the business no longer exists, which can happen for any number of reasons and is self-reported by the founder.

CB Insights conducted research with 111 startups and found these reasons listed most often for why the founder thought the business failed:

- 42% – no market need for their product

- 29% – ran out of cash

- 23% – didn’t have the right team for the business

- 19% – bested by a competitor

- 18% – pricing and cost issues

- 17% – poor product offering

- 17% – lacked a business model

- 14% – poor marketing

- 14% – ignored their customers

7. Which generation is likely to start a business?

Gen Z appears to be one of the most entrepreneurial generations in a very long time. According to a recent survey conducted by JA Worldwide, 53% of Gen Z respondents hope to run their own business within the next ten years; that increases to 65% of respondents of the same age who are already employed.

There may be a number of factors that both push and pull Gen Z, or “Zoomers,” toward entrepreneurship. Gen Z has grown up with the internet and is more familiar with low-cost online business models; Gen Z is also familiar with the power of online communities and the ability to use organic content for marketing a business.

The advantages Gen Z has in these areas may also be bolstered by their disdain for traditional employment compared to previous generations. Many say they face burnout from traditional employment, a trend that is affecting many people post-pandemic but seems to be affecting Gen Z more acutely.

These factors together likely play some role in Gen Z’s willingness to take on the risk of entrepreneurship in exchange for more freedom and income potential.

8. How many jobs do small businesses create?

From 1995 to 2020, small businesses created 12.7 million net new jobs while large businesses created 7.9 million jobs. Small businesses have accounted for 62% of net new job creation since 1995.

It’s important to note that this number is being driven by the outsized impact of new small businesses hiring to get off the ground. Data cited in MIT Press draws the conclusion that it’s not the size of the business that’s most associated with job creation; it’s the age of the business. New businesses create jobs because they’re growing, but they may also remove jobs if they go out of business.

Very small businesses obviously employ very few people, so it’s no surprise that the US Census Bureau’s Statistics found that in 2011, companies with 0-4 employees were only responsible for roughly 5% of all jobs.

However, new businesses are still a key part of offering employment and advancement for those willing to take the risk to join a less established firm.

9. How do small businesses impact the economy?

The US generally has more data on hand for small business impact, and it’s no exception here. The Small Business Administration has published research on this subject every year, and last year, they noted small businesses had this impact on the economy:

- 99.7 percent of U.S. employer firms were small businesses

- 64 percent of net new private-sector jobs were from small businesses

- 49.2 percent of private-sector employment came from small businesses

- 42.9 percent of private-sector payroll is from small businesses

- 46 percent of private-sector output is from small businesses

- 43 percent of high-tech employment is from small businesses

- 98 percent of firms exporting goods are small businesses

- 33 percent of exporting value comes from small businesses

10. What’s the background of small business owners?

Small business owners come from overall very diverse backgrounds. Women and people of color are a much smaller percent of employer firms, however. For nonemployer firms, women founders represent just over 41% of small business owners but only around 20% of employer firms.

Veterans see an outsized presence in employer and nonemployer firms versus their total percentage of the US population, with around 5% of employer firms being started by veterans of the US military.